In 2009, a landmark case highlighted the global fight against corruption. Two United Kingdom citizens were indicted in the United States for their alleged involvement in a scheme to bribe Nigerian government officials.

At the time, the US government wielded a powerful tool to combat such corruption: the Foreign Corrupt Practices Act (FCPA), a law designed to prosecute American citizens and businesses for bribing foreign officials to gain business advantages.

Fast forward to today, and the landscape has shifted dramatically. On Monday, President Donald Trump signed an Executive Order effectively suspending prosecutions under the FCPA. This move has sparked controversy, as it removes a critical deterrent against corruption and raises concerns about the implications for countries like Nigeria, where bribery has long been a challenge in securing government contracts.

The FCPA

The FCPA, enacted in 1977, was a groundbreaking piece of legislation. It aimed to hold US companies accountable for corrupt practices abroad, ensuring that American businesses competed fairly and ethically on the global stage.

The law gained international recognition for its role in prosecuting high-profile cases, including the 2009 Bonny Island scandal, which exposed the widespread use of bribery to secure multi-billion-dollar contracts in Nigeria’s energy sector.

President Trump justified the decision by arguing that the FCPA places US firms at a competitive disadvantage. In his view, the law restricts American businesses from engaging in practices that are allegedly common among foreign competitors, creating an uneven playing field.

While critics have argued that this move undermines decades of progress in the fight against corruption, warning that it could embolden businesses to engage in unethical practices, it is remarkable that much of the attention has been on Nigeria. At the slightest thought, this points to weak governance in the country, and enforcement like Trunp’s makes bribery a pervasive issue.

Let’s Talk Nigeria and Corruption

In recent years, Nigeria’s public system has been thrust into the international spotlight, not for its achievements but for its role in a series of high-profile corruption scandals. These cases, prosecuted under the Foreign Corrupt Practices Act (FCPA), reveal a disturbing pattern of bribery, fraud, and systemic corruption involving Nigerian government officials and foreign corporations.

The Bonny Island Scandal

Between 2008 and 2012, a coalition of four companies known as TSKJ—comprising Technip S.A., Snamprogetti Netherlands B.V., Kellogg Brown & Root Inc. (KBR), and JGC Corporation—was implicated in one of the most audacious bribery scandals ever. They employed two agents—a British lawyer and the Japanese trading giant Marubeni Corporation—to channel millions in bribes to Nigerian officials. Their aim? To secure a series of highly profitable contracts for constructing liquefied natural gas (LNG) facilities on Bonny Island.

This scheme was not only bold but also deeply corrupt. Ultimately, the companies and their agents were caught and prosecuted under the Foreign Corrupt Practices Act (FCPA), leading to a staggering $1.7 billion in fines. While this outcome was a win for anti-corruption advocates, it laid bare the severity of corruption in Nigeria. It exposed a system where contracts worth billions were awarded not on merit but on the willingness to pay the highest bribe.

The Bilfinger Case

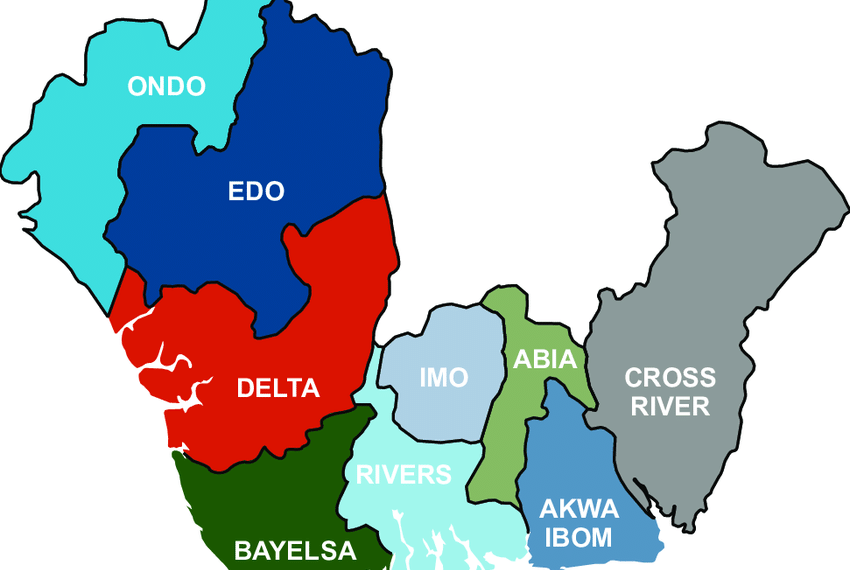

In the case of United States vs. Bilfinger, the company’s Nigerian subsidiary entered into a consortium to bid on the Eastern Gas Gathering System (EGGS) project, a crucial natural gas pipeline system in the Niger Delta. From 2003 to 2005, Bilfinger orchestrated a scheme involving fraudulent loans, fake invoices, and contractual payments to funnel money to two “consultants.” These consultants then bribed Nigerian officials to secure and maintain the EGGS contracts.

When the fraud was uncovered, Bilfinger faced a fine of $32 million and was required to hire an independent compliance monitor for 18 months. While the penalty was significant, it was overshadowed by the damage inflicted on Nigeria’s reputation. This case underscored how easily foreign companies could take advantage of Nigeria’s weak governance, turning public projects into avenues for private profit.

The Parker Drilling Case

In United States vs. Parker Drilling Co., the company’s Nigerian subsidiary, Parker Drilling (Nigeria) Limited, got into trouble over unpaid customs tariffs and duties. When Nigerian customs authorities imposed a fine, Parker allegedly hired a local agent to “fix” the issue. The company authorized payments totaling $1.25 million to this agent, who used the funds to “entertain” the Nigerian officials involved in the customs matter.

As a result, the fine was unexpectedly reduced by 80%. Parker Drilling was later charged with violating the FCPA’s anti-bribery provisions and ordered to pay an $11.76 million penalty. This case was particularly shocking, illustrating how even routine government functions, like customs enforcement, could be manipulated through bribery and “entertainment.”

A System in Crisis

Corruption is a global problem. In 2018, the Organisation for Economic Cooperation and Development (OECD) estimated that the cost of corruption equals more than 5 percent of the global Gross Domestic Product (GDP), with some US$2.6 trillion paid in bribes each year.

Nigeria, Africa’s largest economy, has long struggled with corruption in its public and private sectors. The suspension of the FCPA could have far-reaching consequences for the country. Without the threat of prosecution, US companies may feel empowered to engage in bribery to secure contracts, further entrenching corruption in sectors like energy, infrastructure, and telecommunications.

The incidents discussed are not isolated; they reflect a deeply flawed system. They reveal a public sector where corruption is the norm rather than the exception. Nigerian officials, tasked with protecting the nation’s resources, have repeatedly compromised their integrity for personal gain. Meanwhile, foreign companies, eager to exploit this dysfunction, have turned bribery into a standard business practice.

The repercussions are dire. Billions of dollars that could have been invested in infrastructure, healthcare, or education for Nigeria’s youth have instead been siphoned off by corrupt officials and their accomplices. The fact that these schemes were uncovered and prosecuted primarily by foreign governments—not Nigeria’s anti-corruption agencies—further highlights the failure of Nigerian institutions to hold the powerful accountable.

The Bonny Island case serves as a stark reminder of the scale of corruption that can occur when oversight is lacking. Relying on foreign legislation like the FCPA to curb corruption is no longer a viable strategy. Instead, the country must take proactive steps to ensure transparency, accountability, and fair competition in its business environment. Can Nigerians/Nigeria trust itself to do this?